Roth Tsp Contribution Limits 2024 Over 60

Roth Tsp Contribution Limits 2024 Over 60. Mercer estimates that the annual contribution limit for the tsp and 401 (k) plans will increase from $22,500 in 2023 to $23,000 in 2024. Employees 50 or older can contribute up to.

$8,000 if you’re age 50 or older. Whether you have a roth, traditional or both, your contributions to all of your tsp.

Roth Tsp Contribution Limits 2024 Over 60 Images References :

Source: normabadriena.pages.dev

Source: normabadriena.pages.dev

Tsp Contribution Limits 2024 In Percentage Calculator Jaime Lillian, The 2024 irs annual limit for regular tsp contributions is $23,000.

Tsp Roth Max Contribution 2024 Kelsy Mellisa, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: ruthyqphilippe.pages.dev

Source: ruthyqphilippe.pages.dev

Roth Ira Contribution Limits 2024 Phase Out Leola Nikolia, With roth tsp, your contributions go into the tsp after tax withholding.

Source: gennieqroanne.pages.dev

Source: gennieqroanne.pages.dev

Roth 401 K Contribution Limit 2024 Felice Roxana, The maximum contribution limit for roth and traditional iras for 2024 is:

Source: www.aarp.org

Source: www.aarp.org

Everything You Need To Know About Roth IRAs, That contribution limit will be equal to.

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

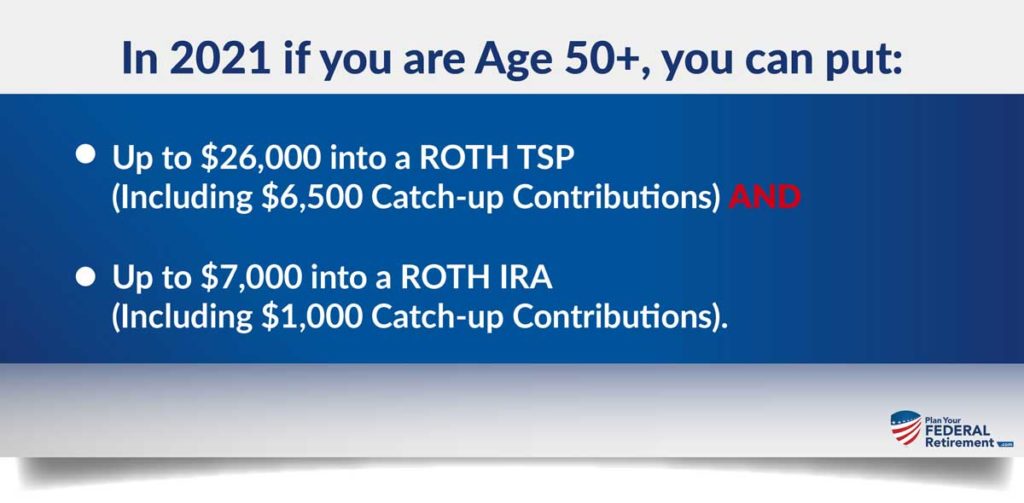

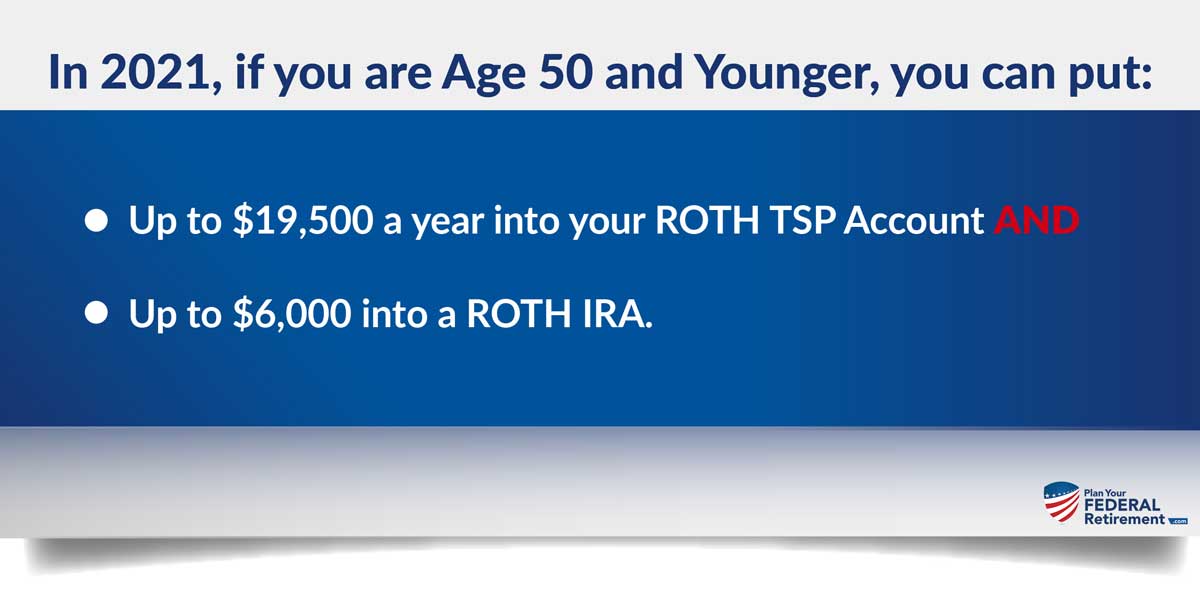

Do Roth Contributions affect my Traditional TSP? Plan Your Federal, Employees 50 or older can contribute up to.

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

Do Roth Contributions affect my Traditional TSP? Plan Your Federal, That notice will explain the higher catch.

Source: sharonwlucy.pages.dev

Source: sharonwlucy.pages.dev

Tsp Roth Contribution Limits 2024 Dorie Geralda, Whether you have a roth, traditional or both, your contributions to all of your tsp.

Source: fallonqlouisette.pages.dev

Source: fallonqlouisette.pages.dev

Roth Tsp Contribution Limits 2024 Lucie Imojean, That means you pay taxes on your contributions at your current income tax rate.

Source: bernadettewlotti.pages.dev

Source: bernadettewlotti.pages.dev

2024 Roth Ira Contribution Limits Meara Sibylla, That means you pay taxes on your contributions at your current income tax rate.

Category: 2024